Forex Sixth Sense is a mechanical trading system. Forex Sixth Sense is a manual strategy that uses momentum and price action with an accuracy of 78.6%. Forex Sixth Sense strategy has been developed by a professional trader Alexander Wood. When it comes to trading, it is always better to be in control of your trading decisions yourself rather than letting a automated robot decide when to trade and when not to trade.

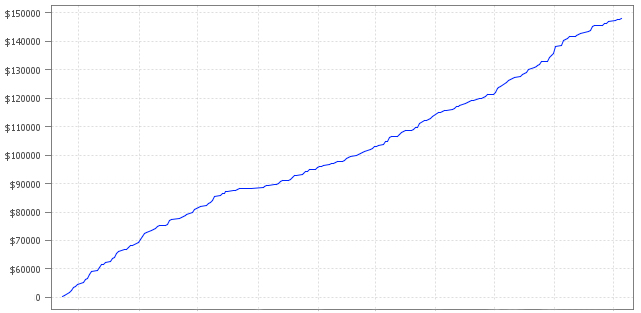

Trading is a visual art. It requires training and practice to learn how to read the charts and interpret them. When you download this Forex Sixth Sense System you are also going to get a number of ebooks. These ebooks will help you to learn how to trade forex if you are a new trader and do not know much about how the currency market works. You might be wondering what is so special about this trading strategy. Well as said above the accuracy rate of this manual strategy is 78.6%. Take a look at the equity curve of this strategy below!

This is a smooth rising equity curve and according to the developer it is very much possible to have 80-90 winning trades out of 100 when using this strategy. A total net profit of $147,654 has been made by this manual strategy. When you download this strategy, you get a set of custom indicators and custom templates that you will be able to automatically install on your charts. Take a look at the following screenshot of this system that shows how it made 305 pips!

The above screenshot shows the custom indicators and the templates. Now if you want you can test this manual strategy on the demo account for two months as it comes with full two months of no questions asked money back guarantee. It is always a good practice to first test a new strategy on the demo account thoroughly before you start trading live with it. Another good practice that you should adopt as a trader is the maintenance of trading journal. Enter the details of each trade into that trading journal.

You see when you will be trading live, you should avoid losing at all costs. This can only be done if you plan each trade meticulously. Trying to be trigger happy when it comes to trading is only going to burn your account. Only pull the trigger when you are damn sure that this is a good trade otherwise avoid pulling it when trading on a live account. This can only happen when you practice a lot with a new strategy or the system on the demo account first.