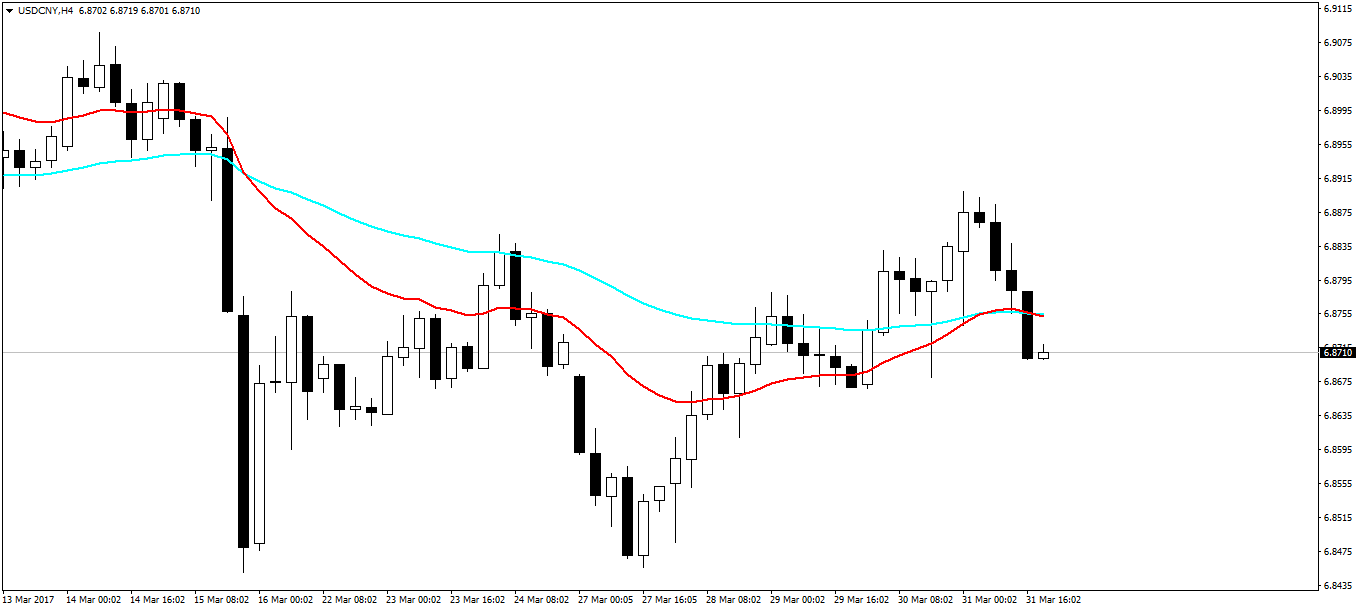

USDCNY is a new pair that is getting popular amongst swing traders. CNY is the Chinese Yuan. Official name is Renminbi. Yuan is the basic unit. So we will use Yuan for CNY. Recently IMF has included Renminbi as an international reserve currency. So CNY is now an international reserve currency alongwith USD, EURO, GBP, and JPY. Did you read the post on NZDUSD sell trade that made 120 pips with 20 pips stop loss? USDCNY is another pair that you should start watching. It can give you good trades. Take a look at the following screenshot of USDCNY H4.

You can see the big candles that are being made on H4. This is a good sign. This means we can trade USDCNY on daily basis.and make some pips. If you daily check the Economic News Calendar you will see CNY also now mentioned in the economic news calendar. So you have another pair that will soon take its place in the major currency pairs. Check with your broker USDCNY spread. Now keep this in mind. Spread is something that the brokers keep on varying depending upon the volatility in the market. Did you read the post on how to trade with Aroon Indicator?

Candlestick patterns are very important in trading. I use them a lot in my trading.If you look at the above chart, you can see that you can easily spot many trading opportunities. I use candlestick patterns to make my entry and exit decisions. The focus in on entering the market with very low risk. Keeping the risk low is the key to winning in forex. I try to catch 100-200 pip moves with a small stop loss of 10-20 pips. You can take a look at my candlestick trading system. I explain everything in a PDF. Keep this in mind. Whatever you do, you cannot avoid losing trades. The only solution that will help you is to keep the risk low and catch big moves that makes 100-200 pips.

Whatever currency pair you trade, technical analysis is the same. In the last post, I tried to build a simple Kalman Filter that we can use in trading. You can read the post on a simple Kalman Filter Trading System. Kalman Filter is being used by hedge funds and the big banks in predicting the market. You should try to learn how to build a Kalman Filter. I have developed this course on Kalman Filter for Traders. You can take this course. In this course I teach you how you can build Kalman Filters and use them in trading.

CNY is being tightly controlled by the Chinese Central Bank. This is just like what the Federal Reserve and the Bank of England and the Bank of Japan do. This is something good. What this means is that there wont be many surprises when trading with USDCNY. Everything have been scripted by the Federal Reserve and the Chinese Central Bank for this pair. If Federal Reserve increases interest rates, plan for a long trade. In the same manner when Chinese Central Bank takes some action, you should be prepared for that if you want to trade USDCNY. Did you read the post on how to trade market reversals?

Trading more pairs gives you the opportunity to make more trades. This is what you should focus on doing. You should focus on making 1000 pips each and every month with a low risk. More pairs you have, more trading setups you get. So you get more opportunities. Add a few more pairs to your trading portfolio in addition to this pair USDCNY. Did you read the post how to trade naked and make 1000 pips?

Naked trading just means that you focus on price action instead of the indicators. Indicators give a lot of false signals. Moreover all the indicators are lagging because they are based on formulas that use price. So instead of focusing on indicators focus on price action and a few leading indicators like the pivot points and the Fibonacci levels. Did you read the post on how to predict the turning points in the market using Fibonacci Levels?

Focus on the weekly and the daily charts. Every Sunday study the weekly charts of these currency pairs. Weekly and daily charts give you the direction in which the market moves. The high and low made on the weekly and daily chart are important levels of support and resistance that can give you good trades. You can watch this video on how to trade on weekly and daily charts. Once you have the direction of the market, you can choose H4 or even H1 for making the entry. I always use H4 for entry as H4 candle is far more reliable as compared to H1 candle.

Now a lot of traders have started using machine learning in their trading. Hedge funds and big banks are the ones who started this trend of using artificial intelligence and machine learning in trading. You can take your trading to a higher level by learning machine learning and artificial intelligence. Artificial intelligence is being used a lot in many different fields now a days. Today more than 80% of the trades that are being made on Wall Street are made by algorithms. So you can well imagine you are in competition with these trading algorithms. The best method to defeat these trading algorithms is to use your own trading algorithms. Read this post on how to use random forest in trading.