This time FOMC Meeting moved the market big time. Strong rumors had started a few days earlier before this FOMC Meeting that the Federal Reserve has decided to raise interest rates this time. So we were already anticipating a big move in the market. The problem with FOMC Meeting is that most of the time the market whipsaws when the meeting minutes are released. Whipsaw means market moves in one direction than it changes direction and starts moving in other direction. This is not a good thing as it means your stop loss can get hit. The solution as always is to enter with low risk and don’t be greedy.

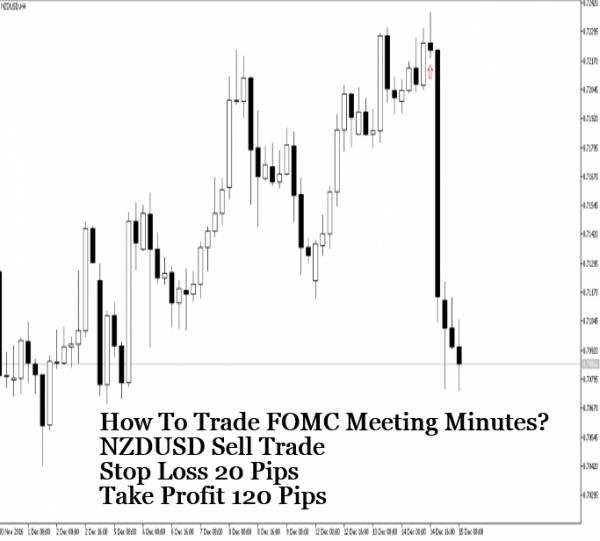

News trading can be highly profitable if you can keep risk low and profits high. Read this post on a news trade that made 350 pips in 4 hours. Take a look at the following screenshot of NZDUSD Sell Trade with a stop loss of 20 pips and take profit target of 120 pips which gives a Reward to Risk ratio of 10:1.

You can see the red arrow in the above screenshot. This was the entry. Did you read the post on how to trade with Aroon Indicator? Just at the close of H4 candle in the above screenshot, we got the opportunity. This bearish Pinocchio bar was a strong signal that NZDUSD is planning to fall down hard. So we opened NZDUSD sell trade with a stop loss of 20 pips. Stop loss was just above the high of this Pinocchio bar. Take profit was set at 120 pips. We always try to have a Reward to Risk of at least 10:1. This ensures that even if we lose our account doesn’t suffer a big loss. Read this post on a 23 year old trader who made $700K in 1 year of live trading.

Now this was it. Once we had opened the trade. There was no point watching the charts. We had placed the trade with the stop loss and the take profit target fixed. So either the stop loss will get hit or the take profit target will get hit. FOMC Meeting Minutes are released at a time which is late night where we live. So we decided to go to sleep. Next morning when we opened MT4, we had a 120 pips profit trade. Watch this documentary on how high frequency trading is done.

Things look easy afterwards. When you are watching the charts, it become tedious. Our solution we only check H4 chart after 4 hours. We don’t continously watch the charts. This gives us the leisure that we want. Just a few minutes before the close of each four hour candle, we open the charts and check what is happening. We have 3 different MT4s with 3 different brokers. One broker is we think stop hunting because there price feed is always 5-10 pips above or below the price feed of the other 2 brokers. Watch this video that explains how you are going to find if your broker is trading against you. Always have 2-3 brokers. Install their MT4s and always compare the price on each. You will soon figure out which broker is cheating.