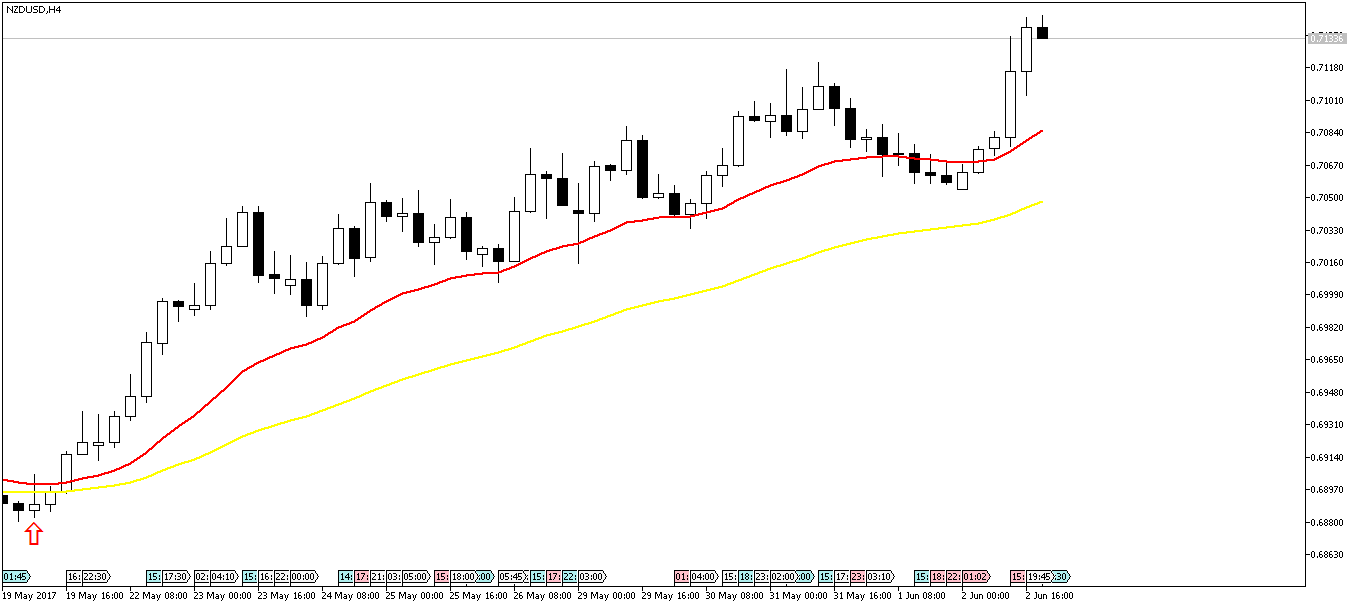

Swing trading is fun if you know how to making winning trades. In swing trading, you get less trades as compared to day trading. The focus is more on quality. In this post I will analyze in detail a recent NZDUSD buy trade with a stop loss of 5 pip and take profit target of 250 pips. Did you read the previous post on FOMC Meeting NZDUSD sell trade? Take a look at the following screenshot.

In the above screenshot, can you see the red arrow? Just above the red arrow is the entry candle. Trading is all about making the right guess. You are always guessing in trading. This is what we do. We try to increase the odds of winning by finding confluence. Confluence means that we try to find 3-4 things that confirm each other before we enter in a trade. In the above screenshot, you can see red line above the yellow line. Red line is the EMA 21 and yellow line is the EMA 55. Red line above the yellow line is a confirmation that market trend is up. So this is our first confirmation for a buy trade. Red line is above yellow line. This is a signal for a long trade. Read the post on how to determine market reversals using daily and weekly candles.

We need to look for a second signal. This signal we get in the shape of the candlestick pattern just above the red arrow. It is clear yellow line is acting as a dynamic line of resistance. So I placed a pending buy limit order with entry at 0.68870. Stop loss is 0.68810..So our risk is only 6 pips. This is the beauty of using a pending limit order. First you analyze the market. You make your decision to open a long trade. You use a pending limit buy order. Take profit is also decided at the time of opening the trade. So the trade is set and forget. Did you read the post on how to trade USD/JPY and make 1000 pips.

There are three possibility. First possibility is stop loss getting hit. The second possibility is trade moving in the right direction but the market failing to hit the take profit target. Third possibility is for the trade to hit the take profit target. Bang! You made a great trade. So our chance of winning is just 1/3 keeping in view we have 3 events in our event space. In the long run what this means is that you are going to win only 1/3 of the trades. Not really! Your chances of winning are a bit higher if you close the trade in case market fails to hit profit target. I use candlestick patterns in determining the take profit targets. Watch this webinar recording on important candlestick breakout patterns.

Let’s take it that our chance of winning is only 1/3. In each 10 trades, we are only going to win 3 trades and lose 3 trades and 3 trades would be breakeven meaning stop loss will not be hit. Suppose we always use a stop loss of 10 pips. 10 pips is a good stop loss. We can always achieve it by using a pending limit order. So on average our stop loss is 10 pips. On average our trades have 200 pips take profit target but we close a trade at 100 pips profit target as well when the market doesn’t cooperate. So on average our profit is 100 pips. We win 6 trades and lose 4 trades. So our loss is 40 pips and our profit is 600 pips. So our net profit is 540 pips. If we can increase the average take profit target to 200 pips we can make much more. In case our average profit target is 200 pips, we make on net 1140 pips which is great. Discover the T Line Trading System that works in all market conditions.

Our target is 1000 pips in 1 month. We just need to make 10 trades. We look for trades that can make us 200 pips per trade with a small stop loss of 15 pips. This is how we are going to win. Coming back to the NZDUSD long trade. Profit target of 250 pips was hit on 4th day. I opened the trade with 1 standard lot. Making 250 pips means I made a profit of $2500. My risk was only $60. Reward/Risk ratio for this trade was great. It was more than 40%. Now you should keep this in mind. Never ever risk more than 2% of your account equity. When you open a trade, you don’t open the second trade as long as the first trade goes into profit. When this happens, you move the stop loss to breakeven. The trade is risk free and now you can look for the second trade.. Always take risk management very seriously. Never risk more than 2% of your account equity on a single trade. If you have $10K in your trading account, 2% risk means you can take a risk of $200. In this case since our risk was only $60, we could have opened the trade with 3 standard lots. This would have resulted in a risk of $180. Your profit would have been $7500. Making $7.5K in 4 days is not a bad idea.

I explain everything in great detail in my candlestick trading system. You can download my Candlestick Trading System. The idea is to catch the big moves in the market with a small stop loss of 10-15 pips. If you can make 100-200 pips per trade with a small stop loss of 10-15 pips, you can easily double your account every month. If you can consistently double your account every month, you can make a million dollar every year. As said above, risk management is the most important thing. You plan a trade. First you analyze the charts then you decide the entry level and the exit level. I use pending limit orders to achieve this. Always use pending limit orders. This way, you don’t need to look at the charts all the time. If your chart analysis is accurate, you have nothing to worry. Look for quality trades. Don’t rush. Just focus on making 1000 pips per month with my candlestick trading systems.